Desk Book: Estates, Reserve Lands Management and Implementation Support for the Family Homes on Reserves and Matrimonial Interests and Rights Act

Table of contents

- Introduction

- Legislation: Family Homes on Reserve and Matrimonial Interests and Rights Act (FHRMIRA)

- Clause by Clause Analysis

- Clause 1 – Short Title

- Clause 2(1) – Definitions

- Clause 2(2) – Words and Expressions

- Clause 14 – After Death

- Clause 15(1) – Consent of Spouse or Common-Law Partner

- Clause 16(6) – Notice of Order

- Clause 34(1) – Entitlement of Survivor

- Clause 34(2) – First Nation Members

- Clause 34(3) – Non-Members

- Clause 34(4) – Determination of Value

- Clause 34(5) – Agreement of Parties

- Clause 34(6) – Definition of "Valuation Date"

- Clause 35 – Variation of Amount

- Clause 36(1) – Determination by Court

- Clause 36(2) – Extension of Time

- Clause 36(3) – Clarification

- Clause 36(4) – Variation of Trust

- Clause 36(5) – Notice to Affected Persons

- Clause 36(6) – Notice to Beneficiaries

- Clause 37 – Survivor's Choice

- Clause 38(1) – Distribution of Estate

- Clause 38(2) – Advances to Dependants

- Clause 38(3) – Two Survivors

- Clause 39 – Improvident Depletion

- Clause 40 – Enforcement of Agreements

- Directive - Receipt of First Nation Laws, Notices, and Orders made pursuant to the Family Homes on Reserves and Matrimonial Interests or Rights Act

- Pamphlet: A Survivor's Entitlement (FHRMIRA)

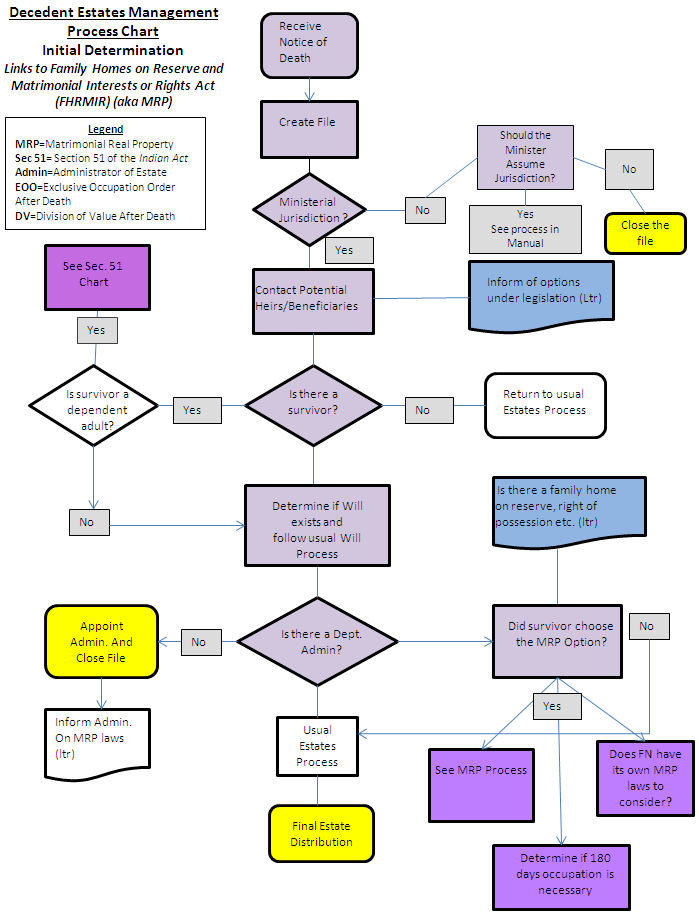

- Decedent Estates Management Process Chart

- Guide for Managing Estates Impacted by the Family Homes on Reserves and Matrimonial Interests or Rights Act

- Estates Template Letters

- Letter 1: Heir is Common-Law Partner and Non-Member (with or without a competing spouse)

- Letter 2: Executor is/is not the Survivor and Survivor is not a Beneficiary

- Letter 3: Executor is not the Survivor and Survivor is Beneficiary (there is a competing spouse)

- Letter 4: No Executor Named/Unwilling/Deceased (survivor is not beneficiary)

- Letter 5: No Executor Named/Unwilling/Dead

(survivor is not a beneficiary and there is a competing spouse) - Letter 6: Executor is Non-Member Survivor and there is a Competing Spouse

- Letter 7: Spouse/Common-Law Partner is Not Executor or a Beneficiary in the Will

- Land Registration and FHRMIRA-Resource Tool

- 1.0 Objective

- 2.0 Current Status

- 3.0 Overview

- 4.0 Provisional Federal Rules

- 5.0 First Nation Law-Making Authority

- 6.0 Application of the Act to First Nations under the First Nations Land Management Act

- 7.0 Application of the Act to Self-Governing First Nations

- 8.0 Implementation

- 9.0 Implications of Provisional Federal Matrimonial Real Property Legislation and Community-Specific Legislation on the Land Registration Process

- 10.0 Estates

- 11.0 Contacts

- Appendices (Forms)

Introduction

The passage of the Family Homes on Reserves and Matrimonial Interests or Rights Act has implications for AANDC officials providing implementation support for the legislation and in the administration of reserve lands and estates that fall under the jurisdiction of the Indian Act. This desk book is intended for use by these officials to assist them in making informed decisions regarding their departmental duties. The procedures set out in this manual are subject to evolving public policy direction, future legislative changes, and case law.

Family Homes on Reserves and Matrimonial Interests or Rights Act

STATUTES OF CANADA 2013

CHAPTER 20

An Act respecting family homes situated on First Nation reserves and matrimonial interests or rights in or to structures and lands situated on those reserves

ASSENTED TO

19th JUNE, 2013

Clause by Clause Analysis

An Act respecting family homes situated on First Nation reserves and matrimonial interests or rights in or to structures and lands situated on those reserves

Preamble

Whereas it is necessary to address certain family law matters on First Nation reserves since provincial and territorial laws that address those matters are not applicable there and since the Indian Act does not address those matters;

Whereas measures are required to provide spouses or common-law partners with rights and remedies during a conjugal relationship, when that relationship breaks down or on the death of a spouse or common-law partner in respect of

- the use, occupation and possession of family homes on reserves, including exclusive occupation of those homes in cases of family violence, and

- the division of the value of any interests or rights that they hold in or to structures and lands on those reserves;

Whereas it is important that, when spouses or common-law partners exercise those rights and seek those remedies, the decision-maker

- take into account the best interests of the children, including the interest of any child who is a First Nation member to maintain a connection with that First Nation, and

- be informed by the First Nation with respect to the cultural, social and legal context in the circumstances;

Whereas the Government of Canada has recognized the inherent right of self-government as an aboriginal right and is of the view that implementation of that right is best achieved through negotiations;

Whereas this Act is not intended to define the nature and scope of any right of self-government or to prejudge the outcome of any self-government negotiation;

And whereas the Parliament of Canada wishes to advance the exercise, in a manner consistent with the Constitution Act, 1982, of First Nations law-making power over family homes on reserves and matrimonial interests or rights in or to structures and lands on reserves;

Now, therefore, Her Majesty, by and with the advice and consent of the Senate and House of Commons of Canada enacts as follows:

What the provision does

Provides background information and explains the circumstances that gave rise to it.

Explanation

Self-explanatory

Short Title

Clause 1 – Short Title

This Act may be cited as the Family Homes on Reserves and Matrimonial Interests or Rights Act.

What the provision does

Provides a short title for this Act.

Explanation

Self-explanatory

INTERPRETATION

Definitions

Clause 2(1) – Definitions

The following definitions apply in this Act.

"council"

"council", in relation to a First Nation, has the same meaning as the expression "council of the band" in subsection 2(1) of the Indian Act.

What the provision does

Defines the term "council" to be consistent with the Indian Act.

Explanation

Self-explanatory

"court"

"court", unless otherwise indicated, means, in respect of a province, the court referred to in any of paragraphs (a) to (e) of the definition "court" in subsection 2(1) of the Divorce Act.

What the provision does

Defines the term "court" for the purposes of this Act.

Explanation

This definition identifies the courts responsible for making determinations under the majority of this Act as the superior courts of the provinces and territories, consistent with the Divorce Act.

"designated judge"

"designated judge", in respect of a province, means any of the following persons who are authorized by the lieutenant governor in council of the province to act as a designated judge for the purposes of this Act:

- a justice of the peace appointed by the lieutenant governor in council of the province;

- a judge of the court in the province; or

- a judge of a court established under the laws of the province.

What the provision does

Defines the term "designated judge", for the purpose of the emergency protection orders in sections 16 to 19 of the Act, to mean a) a provincial justice of the peace appointed by the lieutenant governor in council of the province or territory, (b) a judge of a superior court in a province or territory, or (c) a judge of the provincial or territorial court, as authorized by the lieutenant governor in council of the province or territory to act for these purposes.

Explanation

The Act provides for the use of designated judges to allow an immediate response where applications are made for emergency orders. The possibility of designating judges from various levels of court ensures that applicants in each province and territory have access to existing provincial or territorial frameworks. The use of designated judges also ensures that the necessary conditions are in place to meet the requirements of judicial independence.

"family home"

"family home" means a structure — that need not be affixed but that must be situated on reserve land — where the spouses or common-law partners habitually reside or, if they have ceased to cohabit or one of them has died, where they habitually resided on the day on which they ceased to cohabit or the death occurred. If the structure is normally used for a purpose in addition to a residential purpose, this definition includes only the portion of the structure that may reasonably be regarded as necessary for the residential purpose.

What the provision does

Defines the term "family home" to be the home the couple habitually occupied on reserve.

Explanation

The family home is the structure habitually occupied during the conjugal relationship until the breakdown of that relationship or the death of one of the partners. Only the portion of the structure that is used for residential purposes is covered by the definition.

"First Nation"

"First Nation" means a band as defined in subsection 2(1) of the Indian Act.

What the provision does

Defines the term "First Nation" to be consistent with the definition of "band" in the Indian Act.

Explanation

Self-explanatory

"First Nation member"

"First Nation member" means a person whose name appears on the band list of a First Nation or who is entitled to have their name appear on that list.

What the provision does

Defines the term "First Nation member" to be consistent with the Indian Act.

Explanation

The Indian Act term is "member of a band"; "First Nation" is synonymous with "band" for the purposes of this Act.

"interest or right"

"interest or right" means

- the following interests or rights referred to in the Indian Act:

- a right to possession, with or without a Certificate of Possession or a Certificate of Occupation, allotted in accordance with section 20 of that Act,

- a permit referred to in subsection 28(2) of that Act, and

- a lease under section 53 or 58 of that Act;

- an interest or right in or to reserve land that is subject to any land code or First Nation law as defined in subsection 2(1) of the First Nations Land Management Act, to any First Nation law enacted under a self-government agreement to which Her Majesty in right of Canada is a party, or to any land governance code adopted, or any Kanesatake Mohawk law enacted, under the Kanesatake Interim Land Base Governance Act; and

- an interest or right in or to a structure — that need not be affixed but that must be situated on reserve land that is not the object of an interest or right referred to in paragraph (a) — which interest or right is recognized by the First Nation on whose reserve the structure is situated or by a court order made under section 48.

What the provision does

Defines the term "interest or right" to indicate the interests or rights that are subject to this Act.

Explanation

Included in the definition are interests or rights to possession, leases and permits allotted or issued under the Indian Act, interests or rights granted under the First Nations Land Management Act, the Kanesatake Interim Land Base Governance Act and self-government agreements, and interests or rights to structures or permanent improvements on reserve land that have not been allotted pursuant to the Indian Act.

"matrimonial interests or rights"

"matrimonial interests or rights" means interests or rights, other than interests or rights in or to the family home, held by at least one of the spouses or common-law partners

- that were acquired during the conjugal relationship;

- that were acquired before the conjugal relationship but in specific contemplation of the relationship; or

- that were acquired before the conjugal relationship but not in specific contemplation of the relationship and that appreciated during the relationship.

It excludes interests or rights that were received from a person as a gift or legacy or on devise or descent, and interests or rights that can be traced to those interests or rights.

What the provision does

Defines the term "matrimonial interests or rights" for the purposes of this Act.

Explanation

The definition includes those interests or rights beyond the family home that are held by one or both of the two spouses or common-law partners, and were acquired either during the course of that relationship, or before it but specifically because of that relationship. Interests or rights that an individual received as part of a gift or through a will or intestacy, or bought with any of those, are not included. Where an interest or right was acquired before the relationship, but not specifically because of it, then only the appreciation of that interest or right during the relationship would be included.

"Minister"

"Minister" means the Minister of Indian Affairs and Northern Development.

What the provision does

Specifies the Minister is the Minister of Indian Affairs and Northern Development.

Explanation

Self-explanatory

"peace officer"

"peace officer" means a person referred to in paragraph (c) of the definition "peace officer" in section 2 of the Criminal Code.

What the provision does

Defines the term "peace officer" for the purposes of this Act as an individual referred to in paragraph (c) of section 2 of the Criminal Code.

Explanation

The reference to paragraph (c) of section 2 of the Criminal Code means that individuals who are already appointed and trained for similar purposes will also be used for the purposes of this Act. The term "peace officer" is defined as a police officer, police constable, bailiff, or other person employed for the preservation and maintenance of the public peace or for the service or execution of civil process.

"spouse"

"spouse" includes either of two persons who have entered in good faith into a marriage that is voidable or void.

What the provision does

Expands the ordinary meaning of the term "spouse" as a married person, to also include persons who are not legally married, but who have entered in good faith into a marriage that is voidable or void.

Explanation

This expansion to the usual meaning of the term "spouse" ensures that persons, who, in good faith, believed that they were married but, because of a technicality or other error, are not legally married, are also included.

Words and Expressions

Clause 2(2) – Words and Expressions

Unless the context otherwise requires, words and expressions used in this Act have the same meaning as in the Indian Act.

After Death

Clause 14 – After Death

When a spouse or common-law partner dies, a survivor who does not hold an interest or right in or to the family home may occupy that home for a period of 180 days after the day on which the death occurs, whether or not the survivor is a First Nation member or an Indian.

What the provision does

Sets out a right, for the survivor, to occupy the family home for 180 days after the death of their First Nation member spouse or common-law partner.

Explanation

Provides an automatic right of occupation of the family home to a survivor where they have established a family home on reserve. This provision is not generally found in provincial and territorial family law legislation because of the different context due to different notions of land ownership off reserve. It was specifically added to meet the unique needs identified for the reserve context during the consultations.

Consent of Spouse or Common-Law Partner

Clause 15(1) – Consent of Spouse or Common-Law Partner

Subject to the Indian Act, a spouse or common-law partner who holds an interest or right in or to the family home must not dispose of or encumber that interest or right during the conjugal relationship without the free and informed consent in writing of the other spouse or common-law partner, whether or not that person is a First Nation member or an Indian.

What the provision does

Requires the consent of the spouse or common-law partner for an individual to dispose of or encumber an interest in or right to the family home.

Explanation

Provides that the family home cannot be sold or otherwise disposed of or encumbered during the conjugal relationship without the free and informed written consent of the spouse or common-law partner, regardless of whether or not that spouse or common-law partner is a First Nation member. The provisions of the Indian Actregarding transfer of the right or interest will continue to apply even where the spouse or common-law partner consents to the transaction.

Notice of Order

Clause 16(6) – Notice of Order

Any person against who the order is made and any person specified in the order are bound by the order on receiving notice of it.

What the provision does

Sets out that a person against who the order is made or any person specified in the order is bound by the order as soon as they receive notice of it.

Explanation

Since section 16 is an ex parteproceeding, the order takes effect upon its being made, but the person against whom the order is made is bound by the order as they receive notice of it. This provision ensures the right of an individual to notice of a judicial order that concerns them.

Death of a Spouse or Common-Law Partner

Entitlement of Survivor

Clause 34(1) – Entitlement of Survivor

On the death of a spouse or common-law partner, the survivor is entitled, on application made under section 36, to an amount equal to one half of the value, on the valuation date, of the interest or right that was held by the deceased individual in or to the family home and to the amounts referred to in subsections (2) and (3).

What the provision does

Sets out the entitlement of a survivor to half the value of any interest in or right to the family home that was held by the deceased as well as the amounts described in subsections 34(2) and (3).

Explanation

Provides a presumptive entitlement to a survivor of a half share in the family home, where the deceased had an interest in or right to that home. The entitlement is intended to ensure that a survivor is no worse off after the death that they would have been had they divorced the day before the death.

First Nation Members

Clause 34(2) – First Nation Members

A survivor who is a member of the First Nation on whose reserve are situated any structures and lands that are the object of interests or rights that were held by the deceased individual is also entitled to an amount equal to the total of

- one half of the value, on the valuation date, of matrimonial interests or rights referred to in paragraphs (a) and (b) of the definition "matrimonial interests or rights" in subsection 2(1) that were held by the deceased individual in or to structures and lands situated on a reserve of that First Nation,

- the greater of

- one half of the appreciation in value, between the day on which the conjugal relationship began and the valuation date inclusive, of matrimonial interests or rights referred to in paragraph (c) of that definition that were held by the deceased individual in or to structures and lands situated on a reserve of that First Nation, and

- the difference between the payments that the survivor made towards improvements made, between the day on which the conjugal relationship began and the valuation date inclusive, to structures and lands situated on a reserve of that First Nation that are the object of matrimonial interests or rights referred to in that paragraph (c) that were held by the deceased individual, and the amount of debts or other liabilities outstanding on the valuation date that were assumed to make the payments, and

- the difference between the payments that the survivor made towards improvements made, between the day on which the conjugal relationship began and the valuation date inclusive, to structures and lands situated on a reserve of that First Nation that are the object of interests or rights that were held by the deceased individual that would have been matrimonial interests or rights referred to in that paragraph (c) if they had appreciated during the conjugal relationship, and the amount of debts or other liabilities outstanding on the valuation date that were assumed to make the payments.

What the provision does

Provides a formula to determine the amount to which a survivor (who is a member of the First Nation on whose reserve are situated any structures and lands that are the object of interests or rights held by the other) will be entitled on the death of their First Nations member spouse or common-law partner.

Explanation

A survivor who is a member of the First Nation on whose reserve are situated any structures and lands that are the object of interests or rights held by the deceased spouse or common-law partner (who was also a member of that First Nation) has the same entitlement they would have had under clause 28(2) had they divorced the day prior to the death:

- one-half of the value of the structures or lands that are situated on the reserve that were acquired by the deceased spouse or common-law partner either during the conjugal relationship, or before the conjugal relationship but in specific contemplation of the relationship;

- the greater of either one-half of the appreciation in the value of certain other structures or lands held by the deceased that are situated on the reserve or, the amount of any monetary contributions made by them to improvements to those structures or lands less any remaining outstanding debt incurred for those contributions; and

- where certain other structures or lands held by the deceased that are situated on the reserve did not appreciate in value, the amount of any monetary contributions less any remaining outstanding debt incurred for those contributions.

As in the case of relationship breakdown, interests or rights that were received by the deceased as a gift or legacy or on devise or descent, and interests or rights that can be traced to those interests or rights are excluded.

Non-Members

Clause 34(3) – Non-Members

A survivor who is not a member of the First Nation on whose reserve are situated any structures and lands that are the object of interests or rights that were held by the deceased individual is also entitled to an amount equal to the total of

- one half of the value, on the valuation date, of matrimonial interests or rights referred to in paragraphs (a) and (b) of the definition "matrimonial interests or rights" in subsection 2(1) that were held by the deceased individual in or to structures situated on a reserve of that First Nation,

- the greater of

- one half of the appreciation in value, between the day on which the conjugal relationship began and the valuation date inclusive, of matrimonial interests or rights referred to in paragraph (c) of that definition that were held by the deceased individual in or to structures situated on a reserve of that First Nation, and

- the difference between the payments that the survivor made towards improvements made, between the day on which the conjugal relationship began and the valuation date inclusive, to structures situated on a reserve of that First Nation that are the object of matrimonial interests or rights referred to in that paragraph (c) that were held by the deceased individual, and the amount of debts or other liabilities outstanding on the valuation date that were assumed to make the payments, and

- the difference between the payments that the survivor made towards improvements made, between the day on which the conjugal relationship began and the valuation date inclusive, to the following lands and structures situated on a reserve of that First Nation, and the amount of debts or other liabilities outstanding on the valuation date that were assumed to make the payments:

- lands that are the object of matrimonial interests or rights that were held by the deceased individual, and

- structures that are the object of interests or rights that were held by the deceased individual that would have been matrimonial interests or rights referred to in that paragraph (c) if they had appreciated during the conjugal relationship.

What the provision does

Provides a formula to determine the amount to which a survivor (who is not a member of the First Nation on whose reserve are situated any structures and lands that are the object of interests or rights held by the other) will be entitled from the deceased (who was a member of that First Nation), in the same way that they would have been under clause 28(3) on relationship breakdown.

Explanation

A survivor who is not a member of the First Nation on whose reserve are situated any structures and lands that are the object of interests or rights held by the deceased (who was a member of that First Nation) is entitled to:

- one-half of the value of the structures that are situated on the reserve that were acquired by the deceased either during the conjugal relationship, or before the conjugal relationship but in specific contemplation of the relationship;

- the greater of either one-half of the appreciation in the value of certain other structures held by the deceased that are situated on the reserve or, the amount of any monetary contributions made by them to improvements to those structures less any remaining outstanding debt incurred for those contributions; and

- the difference between the amount of any monetary contributions to certain lands or structures held by the deceased and any remaining outstanding debt incurred for those contributions.

Non-member survivors also do not benefit from the value or appreciation of land situated on reserve, as that land was set aside for the use and benefit of Indians. The exception is to the extent that they have directly contributed to improvements to that land. Interests or rights that were received by the deceased from a person as a gift or legacy or on devise or descent, and interests or rights that can be traced to those interests or rights are again excluded.

Determination of Value

Clause 34(4) – Determination of Value

For the purposes of subsections (1) to (3), the value of the interests or rights is the difference between

- the amount that a buyer would reasonably be expected to pay for interests or rights that are comparable to the interests or rights in question, and

- the amount of any outstanding debts or other liabilities assumed for acquiring the interests or rights or for improving or maintaining the structures and lands that are the object of the interests or rights.

What the provision does

Sets out how the value of the interest or right will be determined.

Explanation

The entitlement of the survivor, rather than being based on the replacement cost of comparable accommodation (on the same reserve if it were available) would be the difference between what a buyer would be reasonably expected to pay for similar interests and any debts related to the interest or rights.

Agreement of Parties

Clause 34(5) – Agreement of Parties

Despite subsection (4), on agreement by the survivor and the executor of the will or the administrator of the estate, the value of the interests or rights may be determined on any other basis.

What the provision does

Allows the survivor and the executor or administrator to choose another method of valuation to which they can agree.

Explanation

Again, the provisional federal rules are intended to encourage settlement of these questions by agreement wherever possible.

Definition of "Valuation Date"

Clause 34(6) – Definition of "Valuation Date"

For the purposes of this section, "valuation date" means

- in the case of spouses, the earliest of the following days:

- the day before the day on which the death occurred,

- the day on which the spouses ceased to cohabit as a result of the breakdown of the marriage, and

- the day on which the spouse who is now the survivor made an application to restrain improvident depletion of the interest or right in or to the family home and of the matrimonial interests or rights that is subsequently granted; or

- in the case of common-law partners, the earlier of the following days:

- the day before the day on which the death occurred, and

- the day on which the common-law partner who is now the survivor made an application to restrain improvident depletion of the interest or right in or to the family home and of the matrimonial interests or rights that is subsequently granted.

What the provision does

Sets out how the valuation date will be selected for the purpose of determining the value for division in the case of an application by a survivor.

Explanation

The valuation date is the point in time at which the value of matrimonial interests or rights is fixed for the purposes of the Act. The valuation date is the earliest of a number of possible dates, set out in this section. Courts will refer to the facts of each particular case in determining which of the possible valuation dates will apply.

Variation of Amount

Clause 35 – Variation of Amount

On application by an executor of a will or an administrator of an estate, a court may, by order, vary the amount owed to the survivor under section 34 if the spouses or common-law partners had previously resolved the consequences of the breakdown of the conjugal relationship by agreement or judicial decision, or if that amount would be unconscionable, having regard to, among other things, the fact that any children of the deceased individual would not be adequately provided for.

What the provision does

Provides for a court to vary the share to which a survivor is entitled if that share would be unconscionable in the circumstances, including those set out.

Explanation

The court is directed to consider a number of factors in determining whether or not the result would be unconscionable, but can also consider factors that are not listed but are raised by the executor or administrator in the specific circumstances.

Determination by Court

Clause 36(1) – Determination by Court

On application by a survivor made within 10 months after the day on which the death of their spouse or common-law partner occurs, a court may, by order, determine any matter in respect of the survivor's entitlement under sections 34 and 35 including

- determining the amount payable to the survivor; and

- providing that the amount payable to the survivor be settled by

- payment of the amount in a lump sum,

- payment of the amount by installments,

- if the survivor is a First Nation member, by the transfer of an interest or right, referred to in subparagraph (a)(i) or paragraph (b) or (c) of the definition "interest or right" in subsection 2(1), in or to any structure or land situated on a reserve of that First Nation, or

- any combination of the methods referred to in subparagraphs (i) to (iii).

What the provision does

Grants the court authority to determine the amount payable to the survivor and how that amount should be paid.

Explanation

This provision sets a cut-off of ten months after the death for the survivor to apply for a division. The court can determine how much the survivor is owed, and how that amount should be paid. The ten month period would balance the desire to allow the survivor time to take the necessary steps with the need to settle the estate to the benefit of any children or other beneficiaries.

Extension of Time

Clause 36(2) – Extension of Time

On application by the survivor, a court may, by order, extend the period of 10 months by any amount of time that it considers appropriate, if the court is satisfied that the survivor failed to make an application within that period for any of the following reasons:

- the survivor did not know of the death of their spouse or common-law partner until after the period expired;

- circumstances existed that were beyond the control of the survivor; or

- only after the period expired did the applicant become aware of any interests or rights referred to in subsections 34(1) to (3).

What the provision does

Allows the court to extend the time limit for the survivor to apply for a division under three specific circumstances.

Explanation

This section allows the court to extend the ten month limitation period for an application for division where the survivor can establish that they fit within paragraph (a), (b) or (c).

Clarification

Clause 36(3) – Clarification

A transfer may be ordered under subsection (1)

- in the case of a First Nation that is not referred to in any of paragraphs (b) to (d), despite sections 24 and 49 of the Indian Act;

- in the case of a First Nation as defined in subsection 2(1) of the First Nations Land Management Act, subject to any land code or First Nation law as defined in that subsection to which the First Nation is subject;

- in the case of a First Nation that has entered into a self-government agreement to which Her Majesty in right of Canada is a party, subject to any First Nation law enacted under the agreement; or

- in the case of the Mohawks of Kanesatake, subject to any land governance code adopted, or any Kanesatake Mohawk law enacted, under the Kanesatake Interim Land Base Governance Act.

What the provision does

Specifies that a transfer of interests or rights remains subject to certain conditions.

Explanation

In the case of a First Nation with its own land code or law – either under the First Nations Land Management Act, a self-government agreement or the Kanesatake Interim Land Base Governance Act – the transfer can only be ordered where it is consistent with that land code or law. In the case of any other First Nation, a transfer may occur despite section 24 of the Indian Act(which requires the consent of the Minister).

Variation of Trust

Clause 36(4) – Variation of Trust

On application by a survivor, an executor of a will or an administrator of an estate, the court may, by order, vary the terms of a trust that is established under the terms of the deceased individual's will so that the amount that is payable to the survivor may be paid.

What the provision does

Allows the court to vary the terms of any trust set up under the deceased's will, if necessary to allow for payment to the survivor.

Explanation

Self-explanatory

Notice to Affected Persons

Clause 36(5) – Notice to Affected Persons

An applicant for an order under this section must, without delay, send a copy of the application to the following persons, to the Minister and to any other person specified in the rules regulating the practice and procedure in the court:

- in the case where the applicant is the survivor, to the executor of the will or the administrator of the estate, if the applicant knows who those persons are; or

- in the case where the applicant is the executor of a will or an administrator of an estate, to the survivor.

What the provision does

Directs the applicant to send copies of their application to certain individuals who could be directly affected if the court grants the order.

Explanation

Allows certain individuals who could be directly affected by the court order to be aware of the application and to decide whether or not to ask the court to hear their views before the order is made. The Minister is included because of his or her responsibilities for estate administration under the Indian Act.

Notice to Beneficiaries

Clause 36(6) – Notice to Beneficiaries

On receipt of the copy of the application, the executor of the will or the administrator of the estate or, if neither has been appointed, the Minister must, without delay, send a copy of the application to the named beneficiaries under the will and the beneficiaries on intestacy.

What the provision does

Provides that the executor of the will or administrator of the estate who receives notice of the application must notify the beneficiaries of the will or estate. If neither an executor nor an administrator has been appointed the Minister must make the notification.

Explanation

The executor or administrator act on behalf of the beneficiaries, and if those beneficiaries are made aware of the application, they may decide to ask the executor or administrator to in turn ask the court to hear their views before the order is made. In the absence of an executor or administrator, the Minister has the responsibility of notifying the beneficiaries of the application.

Survivor's Choice

Clause 37 – Survivor's Choice

If a court decides, after the death of a spouse or common-law partner, that an amount is payable to the survivor under section 30 or 36, the survivor may not, in respect of the interest or right in or to the family home and of the matrimonial interests or rights, benefit from the deceased individual's will or sections 48 to 50.1 of the Indian Act.

What the provision does

Provides that once a court has made a determination on an application for the division of the value of the family home and other matrimonial interests or rights, the survivor who made the application cannot also benefit from the deceased's will or under the intestacy provisions of the Indian Act in respect of the same interests or rights.

Explanation

The provisional federal rules seek to ensure that the survivor is not disadvantaged by providing access to the same recourse that would have been available had the couple divorced instead the day before the death. However, where the survivor chooses to apply for a division instead of taking their portion under a will or intestacy, they also should not be allowed to effectively "double-dip" or it would be unfair to other beneficiaries. The survivor would still be able to receive any specific personal bequests or movables.

Distribution of Estate

Clause 38(1) – Distribution of Estate

Subject to subsection (2), an executor of a will or an administrator of an estate must not proceed with the distribution of the estate until one of the following occurs:

- the survivor consents in writing to the proposed distribution;

- the period of 10 months referred to in subsection 36(1) and any extended period the court may have granted under subsection 36(2) have expired and no application has been made under subsection 36(1) within those periods; or

- an application made under subsection 36(1) is disposed of.

What the provision does

Prevents the executor or administrator from distributing the estate until either the survivor consents in writing to the distribution, the time period during which the survivor must apply to the court for a determination of entitlement has expired, or any application by the survivor has been disposed of by the court.

Explanation

This provision protects the assets of the deceased's estate until after the survivor has had the opportunity to consider whether to choose to inherit from the estate or to apply to the court under this Actfor a share of the value of the family home and any matrimonial interests or rights.

Advances to Dependants

Clause 38(2) – Advances to Dependants

Subsection (1) does not prohibit reasonable advances to survivors or other dependants of the deceased spouse or common-law partner for their support.

What the provision does

Allows for certain limited payments to the dependants of the deceased from the deceased's estate, despite the prohibition in section 38(1).

Explanation

The executor or administrator, although prohibited from distributing the estate, may nevertheless make reasonable advances from the estate's assets to support dependants of the deceased.

Two Survivors

Clause 38(3) – Two Survivors

When there are two survivors — a common-law partner and a spouse with whom the deceased individual was no longer cohabiting — and an amount is payable to both under an order referred to in section 36, the executor of the will or the administrator of the estate must pay the survivor who was the common-law partner before paying the survivor who was the spouse.

What the provision does

Sets out the order of payment in the rare event that an individual dies leaving a married, separated spouse and a subsequent common-law partner with whom they are living at the time of death.

Explanation

This provision requires the deceased's executor or administrator to pay the common-law partner before paying the separated, married spouse. This is because the common-law partner was living with the deceased at the time of death and is presumed to be more dependent than the separated, married spouse who is presumed to have had time to resolve some or all of the consequences of the breakdown of their relationship with the deceased.

This provision addresses the only possible circumstance where in law there could be two survivors, that is, on the day of death, the deceased was separated but not divorced from a married spouse, and in a common-law relationship that had begun after the separation.

Improvident Depletion

Clause 39 – Improvident Depletion

On application by a survivor, a court may make any order that it considers necessary to restrain the improvident depletion of the interest or right in or to the family home and of the matrimonial interests or rights for the purpose of protecting

- the right that might be granted to the survivor in an order made under section 21 or any interest or right that might be transferred to the applicant in an order made under section 36; or

- the value of the interests or rights that will be used to determine the amount that might be payable to the survivor in an order made under section 36.

What the provision does

Allows the court to grant an order to protect and preserve the value of the family home or any matrimonial interests or rights.

Explanation

This provision allows a court to intervene to protect the interest of the survivor if there is an intention to deliberately lessen the value of the family home or matrimonial interests or rights.

Enforcement of Agreements

Clause 40 – Enforcement of Agreements

If a survivor and the executor of the will or the administrator of the estate enter into a written agreement that sets out the amount to which the survivor is entitled and how to settle the amount payable by one or both of the methods referred to in subparagraph 36(1)(b)(i) or (ii), a court may, on application by one of them, make an order to enforce that agreement if the court is satisfied that the consent of the survivor to the agreement was free and informed and that the agreement is not unconscionable.

What the provision does

Allows a survivor, executor or administrator to apply to the court to enforce a provision of a written agreement, where they can satisfy the court that there was sufficient consent and that the agreement is not unconscionable.

Explanation

Written agreements are enforceable by application to a court, except where the court finds that the agreement is unconscionable or that consent was not freely given.

Directive: Receipt of First Nation Laws, Notices, and Orders made pursuant to the Family Homes on Reserves and Matrimonial Interests or Rights Act

Purpose: The purpose of this directive is to provide instructions to Aboriginal Affairs and Northern Development Canada officials regarding the handling of First Nations' laws, orders, and notices received pursuant to the Family Homes on Reserves and Matrimonial Interests or Rights Act.

Background

Matrimonial real property includes land held by one or both spouses or common-law partners and used by the family, as well as houses, sheds and any other property that is attached to the land. Many of the legal protections relating to matrimonial real property interests or rights that are applicable off reserves were not available to individuals on reserves.

To address the legislative gap, the Family Homes on Reserves and Matrimonial Interests or Rights Act was adopted. It is structured in two main parts. The first part, up to section 11 and section 53, came into force on December 16, 2013, and provides specific law-making authority to certain First Nations (those whose reserve lands continue to be guided by the Indian Act), to create community-specific matrimonial real property laws.

The second part of the Act, sections 12 to 52, sets out provisional federal rules which will apply until a First Nation law is enacted under this Act or other federal legislation. The federal rules will come into force on December 16, 2014.

The legislation requires that First Nations send copies of their community-specific laws to the Minister of Aboriginal Affairs and Northern Development. If a First Nation is operating under the provisional federal rules of the legislation rather than their own matrimonial real property law, then copies of specific notices and orders made pursuant to the federal rules of the Act must also be sent to the Minister of Aboriginal Affairs and Northern Development and to First Nation councils.

Notices and orders may be related to exclusive occupation of the family home, emergency protection orders in situations of family violence, and spousal or common-law entitlement upon relationship breakdown or death. Applicants must also send notice of application and orders to their First Nation council except with respect to the initial application and/or granting of emergency protection orders.

It is anticipated that departmental officials will be receiving copies of First Nation laws as well as copies of notices and orders made under the provisional federal rules of the Act. First Nations or individuals may send these documents to Aboriginal Affairs and Northern Development Canada officials operating in the regions or in headquarters.

Directive:

Copies of First Nation Laws must be forwarded to: The Lands Modernization Directorate, the Royal Canadian Mounted Police, and relevant Regional Officials.

Copies of notices/orders must be forwarded to: The Lands Modernization Directorate, Lands Directorate, Estates Directorate, the First Nations Lands Management Directorate, and relevant Regional Officials.

General inquiries from First Nations regarding the Act must be forwarded to: The Centre of Excellence for Matrimonial Real Property.

All hard copies of Notices, Orders, and Laws will be maintained by the Corporate Information Management Directorate at Aboriginal Affairs and Northern Development Canada in accordance with the file numbers indicated in Annex A.

Contact information regarding the aforementioned officials and the Centre of Excellence for Matrimonial Real Property is located in Annex B.

More detailed information regarding roles and responsibilities is outlined below.

Roles and Responsibilities:

Lands Modernization Directorate, Headquarters:

This directorate is responsible for maintaining the published list of the First Nations laws made pursuant to the Family Homes on Reserves and Matrimonial Interests or Rights Act on the AANDC website. The Indian Lands Registry will make a notation on the Reserve General that a First Nation has a community-specific matrimonial real property law in place, but the Indian Lands Registry will not publish the content of the law.

Should the directorate be in receipt of First Nation laws, notices, or orders, copies of those documents must be provided to the relevant region(s). The Directorate should contact the Lands Directorate and Estates Directorate in Headquarters to ascertain the appropriate regional contact to whom the law, notice or order should be sent.

Further, the directorate will be required to notify the Estates Directorate and the First Nations Land Management Directorate regarding the receipt of any orders or notices, if necessary. The directorate is also responsible for providing a copy of any First Nation law received to the Royal Canadian Mounted Police.

Lands Directorate and Estates Directorate, Headquarters:

If a departmental official receives a copy of a notice or an order, please refer to the Indian Lands Registration Manual and/or contact the Estates Directorate for next steps, as notices and orders may have implications for both lands and estates-related matters.

Regional Officials:

If a departmental official in a region receives a copy of a First Nation law the original document must be mailed to the Lands Modernization Directorate at Aboriginal Affairs and Northern Development Canada. The address is as follows:

LANDS MODERNIZATION DIRECTORATE

Aboriginal Affairs and Northern Development Canada

10 WELLINGTON ST, 17TH Floor

GATINEAU, QC K1A 0H4

If a departmental official receives a copy of a notice or an order, please refer to the Indian Lands Registration Manual and/or contact the Estates Directorate for next steps, as notices and orders may have implications for both lands and estates-related matters.

All Officials:

Depending on whether an official receives a First Nation law, notice, or an order, it is the responsibility of the official to ensure an official from each area indicated in the "directive" heading above is made aware of the relevant document.

For all hard copies of notices, orders, and laws, ensure that a file number and protected level are written on each document before providing to the Corporate Information Management Directorate. See Annex A for complete list of naming conventions and file number and security designations.

Should departmental officials receive any queries from First Nations concerning the legislation, they should direct the First Nations to the Centre of Excellence for Matrimonial Real Property.

Annex A:

Naming Conventions for Laws, Notices, and Orders received pursuant to the Family Homes on Reserves and Matrimonial Interests or Rights Act

| Subject of Document | Naming Convention for Document | File Number and Security Designation |

|---|---|---|

| First Nation Laws | ||

| Result of vote and Law | MRP Name of First Nation Name of First Nation Law YYYY-MM-DD | E4085-10-3 (Protected B) |

| Amended Law | MRP Name of First Nation Amended Name of First Nation Law YYYY-MM-DD | E4085-10-3 (Protected B) |

| Notice that First Nation Law has been repealed | MRP Name of First Nation Repealed Name of First Nation Law YYYY-MM-DD | E4085-10-3 (Protected B) |

| Notice that a Self-Governing First Nation has enacted a law | MRP Name of Self-Governing First Nation Name of First Nation Law YYYY-MM-DD | E4085-10-3 (Protected B) |

| Occupation by Both Spouses | ||

| Order to set aside a transaction and impose conditions on any future disposition or encumbrance of that interest or right by the spouse or common-law partner to whom the interest or right reverts | MRP Order Conditions for future disposition or encumbrance YYYY-MM-DD Registry Number | E4085-10-2 (Protected B) |

| Order to authorize a person to dispose of or encumber that interest or right without the required consent of the other spouse or common-law partner if that the other spouse or common-law partner cannot be found, is not capable of consenting or is unreasonably withholding consent | MRP Order to dispose or encumber without required consent YYYY-MM-DD Registry Number | E4085-10-2 (Protected B) |

| Emergency Protection Order | ||

| 90 days Emergency Protection Order made by designated judge | MRP Emergency Protection Order 90 Days YYYY-MM-DD Registry Number | E4085-10-2 (Protected B) |

| Order by the court to confirm or direct a rehearing | MRP Emergency Protection Order Rehearing YYYY-MM-DD Registry Number | E4085-10-2 (Protected B) |

| Notice of the decision and any consequent procedures by the court | MRP Emergency Protection Order Notice of decision YYYY-MM-DD Registry Number | E4085-10-2 (Protected B) |

| Order by the court on a rehearing that confirms, varies or revokes an order made under section 16(1) | MRP Emergency Protection Order upon rehearing confirmation, variation, or revocation of an Order YYYY-MM-DD Registry Number | E4085-10-2 (Protected B) |

| Order that confirms, varies or revokes an order made under section 16(1) | MRP Emergency Protection Order confirmation, variation, or revocation of an Order YYYY-MM-DD Registry Number | E4085-10-2 (Protected B) |

| Exclusive Occupation | ||

| Order that grants exclusive occupation of the family home to one spouse | MRP Exclusive Occupation Order YYYY-MM-DD Registry Number | E4085-10-2 (Protected B) |

| Interim order to grant exclusive occupation of the family home to one spouse | MRP Exclusive Occupation Interim Order YYYY-MM-DD Registry Number | E4085-10-2 (Protected B) |

| Order to confirm, vary or revoke an exclusive occupation order | MRP Exclusive Occupation Order confirmation, variation, or revocation YYYY-MM-DD Registry Number | E4085-10-2 (Protected B) |

| Order granting exclusive occupation to a survivor | MRP Exclusive Occupation Order for survivor YYYY-MM-DD Registry Number | E4085-10-2 (Protected B) |

| Interim order to grant exclusive occupation of the family home to a survivor | MRP Exclusive Occupation Interim Order for survivor YYYY-MM-DD Registry Number | E4085-10-2 (Protected B) |

| Order to confirm, vary or revoke an order of exclusive occupation to the survivor | MRP Exclusive Occupation Order confirmation, variation, or revocation of an Order for survivor YYYY-MM-DD Registry Number | E4085-10-2 (Protected B) |

| Applications for orders under section 21 (exclusive occupation by the survivor) | MRP Exclusive Occupation Order application for Order under s.21 (survivor) YYYY-MM-DD Registry Number | E4085-10-2 (Protected B) |

| Other Provisions | ||

| Order that varies the amount owed by or to the applicant under section 28 | MRP Order for variation of amount owed by or to applicant YYYY-MM-DD | E4085-10-2 (Protected B) |

| Order that determines the entitlement to the value of the family home under section 28 and 29 | MRP Order entitlement to value of the family home under s.28 and 29 YYYY-MM-DD | E4085-10-2 (Protected B) |

| Order to extend the time to apply for value | MRP Order extension of time to apply for value YYYY-MM-DD | E4085-10-2 (Protected B) |

| Order to transfer an interest or right | MRP Order to transfer interest or right YYYY-MM-DD Registry Number | E4085-10-2 (Protected B) |

| Order to restrain the depletion of the interest or right in the family home | MRP Order to restrain the depletion of the interest or right in the family home YYYY-MM-DD Registry Number | E4085-10-2 (Protected B) |

| Order to enforce a written agreement | MRP Order to enforce a written agreement YYYY-MM-DD Registry Number | E4085-10-2 (Protected B) |

| Order to vary the amount owed to the survivor | MRP Order to vary amount owed to the survivor YYYY-MM-DD | E4085-10-2 (Protected B) |

| Order that determines the entitlement to the value of the family home for the survivor | MRP Order that determines the entitlement to value of family home for survivor YYYY-MM-DD | E4085-10-2 (Protected B) |

| Order to extend the period of 10 months for the survivor to apply for entitlement | MRP Order to extend the period of 10 months for survivor to apply for entitlement YYYY-MM-DD | E4085-10-2 (Protected B) |

| Order to vary the terms of a trust established under a will | MRP Order to vary terms of trust established under a will YYYY-MM-DD | E4085-10-2 (Protected B) |

| Applications for orders regarding survivor entitlement under s.36 | MRP Order under s.36 YYYY-MM-DD Registry Number | E4085-10-2 (Protected B) |

| Order to restrain the depletion of the interest or right in the family home (Estate) | MRP Order to restrain depletion of interest or right to family home Estate YYYY-MM-DD Registry Number | E4085-10-2 (Protected B) |

| Order to enforce a written agreement (Estate) | MRP Order to enforce a written agreement Estate YYYY-MM-DD Registry Number | E4085-10-2 (Protected B) |

| Order that determines who holds an interest or right (Estate) | MRP Order to determine holder of interest or right Estate YYYY-MM-DD Registry Number | E4085-10-2 (Protected B) |

Annex B:

Contact Information

Department of Aboriginal Affairs and Northern Development Canada

Kris Johnson, Senior Director, Lands Modernization Directorate, Wellington Street, Gatineau, QC, K1A 0H4, Kris.Johnson@aadnc-aandc.gc.ca, Tel: 819-994-7311

Sarah Crowe, Manager of Estates, Estates Directorate, 10 Wellington Street, Gatineau, QC, K1A 0H4, Sarah.Crowe@aadnc-aandc.gc.ca, Tel: 819-934-3118.

Darryl Hargitt, Registrar of Indian Lands, Lands Directorate, 10 Wellington Street, Gatineau, QC, K1A 0H4, Darryl.Hargitt@aadnc-aandc.gc.ca, Tel: 819-956-8742.

Cheri Reddin, Director of First Nations Land Management Directorate, First Nations Land Management Directorate, 10 Wellington Street, Gatineau, QC, K1A 0H4, Cheri.Reddin@aadnc-aandc.gc.ca, Tel: 819-994-2210.

Monica Fuijkschot, Director, Corporate Information Management Directorate, 10 Wellington Street, Gatineau, QC, K1A 0H4, Monia.Fuijkschot@aadnc-aandc.gc.ca, Tel: 819-953-7062.

Manon Robitaille, Records Classifier and Researcher, National Capital Region's Records Operations, 10 Wellington Street, Gatineau, QC, K1A 0H4, Manon.Robitaille@aadnc-aandc.gc.ca, Tel: 819-934-7011.

Royal Canadian Mounted Police

Stephen Thorne, Sergeant, Senior Policy Analyst, National Aboriginal Policing Services, Royal Canadian Mounted Police, Steve.Thorne@rcmp-grc.gc.ca, Tel: (613) 843-6305

Kurtis Kamotzki Sergeant, Senior Policy and Program Analyst, National Aboriginal Policing Services, Royal Canadian Mounted Police, Kurt.Kamotzki@rcmp-grc.gc.ca, Tel: (613) 843-3389

Centre of Excellence for Matrimonial Real Property

Centre of Excellence for Matrimonial Real Property, 1024 Mississauga Street

Curve Lake, ON, K0L 1R0, Tel: (705) 657-9992, Toll free: (855) 657-9992, Fax: (705) 657-2999.

Pamphlet: A Survivor's Entitlement (FHRMIRA)

A Survivor's Entitlement

The Family Homes on Reserves and Matrimonial Interests or Rights Act (Act) provides new rights for survivors. A survivor, in relation to a deceased individual, means their surviving spouse or common-law partner. This Act provides entitlement to survivors in a manner that is consistent with most provincial family and succession laws related to matrimonial real property.

The survivor of the estate has 2 options:

- The survivor may choose to apply to court for an amount equal to half the value of the deceased's interest in or right to the family home and other matrimonial interests or rights under the provisional federal rules in the Act,

or;

- The survivor may choose to inherit from the deceased's will or under the estates provisions of the Indian Act in respect of the family home and other matrimonial interests.

In both cases, the option is specific to the matrimonial home or other matrimonial interests or rights. It does not preclude the survivor from inheriting other assets from the deceased, such as personal items.

Option 1

To claim survivor rights and interests under the provisional federal rules, a survivor has to make an application to the court within 10 months of the death of their spouse or common-law partner. Survivors may be entitled to an amount equal to half the value of the deceased's interests in or right to the family home. A court can extend the 10-month period under the following three considerations:

- The survivor did not know of the death until after the period expired;

- Circumstances existed that were beyond the control of the survivor; or

- It was only after the period expired that the survivor became aware of eligible interests or rights.

The applicant for survivor entitlement must send copies of their application to certain individuals who could be directly affected if the court grants the order. In the case where the applicant is the survivor, the applicant must, without delay, send a copy of the application to the Minister and to the executor of the will or the administrator of the estate, if known. In the case where the applicant is the executor of a will or an administrator of an estate, the applicant must, without delay, send a copy of the application to the Minister and to the survivor.

Further, the executor of the will or administrator of the estate who receives notice of such an application must notify beneficiaries of the will or heirs to the estate. If neither an executor nor an administrator has been appointed, the Minister must make the notification.

Notes:

- Once the family home and matrimonial rights or interests have been distributed, the remainder of the estate will be distributed to the remaining heirs or beneficiaries as per the will or section 48 of the Indian Act.

- The Indian Act estate provisions will apply if the survivor's application is not made to the court within the 10-month period.

Option 2

Note:

- If the family home (or other property) is held by the spouses or common-law partners in "joint tenancy" there is a right of survivorship which allows the deceased's interest in the home to transfer directly to the survivor upon death. Such property does not flow through the estate (i.e., will, intestacy or the provisional federal rules of the Act).

Decedent Estates Management Process Chart

Guide for Managing Estates Impacted by the Family Homes on Reserves and Matrimonial Interests or Rights Act (FHRMIRA)

(Developed to Assist Estates Officers with the Implementation of FHRMIRA)

| Letter | Details of Estate | Steps | Potential Sec. 50 Impact | Competing Spouse | |

|---|---|---|---|---|---|

| 1A | 1 |

|

|

No | Yes |

| 1B | 1 |

|

|

Yes | Yes |

| 1C | Standard Estates Letter |

|

|

No | Yes |

| 1D | Standard Estates Letter |

|

|

Yes | Yes |

| 1E | 1 |

|

|

No | No |

| 1F | Standard Estates Letter |

|

|

No | No |

| 1G | Standard Estates Letter |

|

|

Yes | No |

| 2A | 2 |

|

|

No | No |

| 2B | 2 |

|

|

No | No |

| 3A | 3 |

|

|

No | Yes |

| 3B | 3 |

|

|

No | No |

| 4A | 4 and 7 |

|

|

No | No |

| 5A | 5 |

|

|

No | Yes |

| 5B | 5 |

|

|

No | No |

| 6 | 6 |

|

|

Yes | Yes |

Estates Template Letters

Important follow-ups for Departmental Administrators with regards to the provisions of the FHRMIRA:

- Ensure that beneficiaries are notified of Orders made under the FHRMIRA.

- If a court decides that an amount is payable to the survivor under section 30 or 36 of the FHRMIRA the survivor cannot benefit (re: family home or matrimonial/family interests or rights) from the will or sections 48-50.1 of the IA.

- Distribution of an estate shall not proceed until:

- The survivor consents in writing to the proposed distribution

- The period of 10 months (or extension) has expired and no application has been made

- An application made under subsection 36(1) is disposed of

- When there are 2 survivors,(a common-law partner and a spouse), and an order (section 36) to pay both, the executor/administrator must pay the survivor who was the common-law partner before paying the survivor who was the spouse.

- Complete the Matrimonial Real Property Assessment Form Section I and IV when transferring land. Contact the First Nation to determine if a court order has been issued.

Letter insert A

Also, in collaboration with First Nation people, communities and groups, Aboriginal Affairs and Northern Development Canada (AANDC) developed legislation to address a long-standing and unacceptable legislative gap in regards to the rights of the surviving spouse(s) to reside in, or claim an interest in the family home (for example). Please see the attached pamphlet for more information on the Family Homes on Reserves and Matrimonial Interests or Rights Act.

Letter insert B

Insert - if there is a competing spouse

We have information that shows [NAME] as the spouse of the deceased. This legislation may affect your rights as a survivor (common-law partner) and you are encouraged to seek legal advice to decide whether to pursue your rights under either the Indian Act or the Family Homes on Reserves and Matrimonial Interests or Rights Act. Please keep in mind that you have only ten months after the date of death in which to make your application to court regarding the family home, or, if the deadline has expired, you can make application to the court for additional time.

Insert - if there is a competing spouse and FNLMA Band

[We have information that shows [NAME] as the spouse of the deceased.] You are encouraged to contact the band for information about reserve land in the name of the deceased and the Matrimonial Real Property provisions under the band's land code. As the survivor (common-law partner) your rights may be affected by those provisions.

Insert - if there is a competing spouse and First Nation has its own MRP Law under FHRMIRA

[We have information that shows [NAME] as the spouse of the deceased.] You are encouraged to contact the band for information about reserve land in the name of the deceased. Also, as the survivor (common-law partner) the provisions in the band's Matrimonial Real Property law may affect your rights.

Letter 1

HEIR IS COMMON LAW PARTNER AND NON-MEMBER

(with or without a competing spouse)

Our file:

DATE

NAME

STREET ADDRESS

CITY PROVINCE POSTAL CODE

Dear NAME

Re: [NAME OF DECEASED]

I am an Estates Officer with Aboriginal Affairs and Northern Development Canada (AANDC) and I work on the estates of deceased First Nations people who lived on reserve. I have recently been informed of the death of [NAME]. Please accept our sincere condolences for your loss.

[NAME] was a status First Nations person who lived on-reserve. As a result, the legal rules that apply to his/her estate come from the Indian Act, and not from the laws of the Province of [Province or Territory]. Under the Indian Act, someone has to be appointed by the Minister of Indian Affairs to administer an estate.

You are an heir to the estate and I am writing to ask how you want to proceed with [NAME'S] estate.

You have two options. Please choose only one of them:

- If you are willing and able to take on the job of being the administrator of your common law partner/'s estate, please complete Parts XX, XX and XX of the enclosed Application for Administration form, and return it to me. If you apply and are appointed, I will provide you with a legal document confirming that you have been officially appointed to look after the estate.

OR:

- If you are not able to (or would rather not) take on the job of being the administrator, you may nominate someone else. Please complete Parts XX and XX of the enclosed Application for Administration form, and have the person you have chosen complete Parts XX and XX, to show that they will agree to look after the estate.

Insert - if Common-law partner is Non-member.

Under section 50 of the Indian Act, since you are not a member of [XX Band], you are not entitled to hold title to reserve land. We have policies about how to deal with this issue and we will discuss it with you in more detail at a later date.

Insert - if the First Nation is not under FNLMA or does not have their own MRP law pursuant to the FHRMIRA.

Also, in collaboration with First Nation people, communities and groups, Aboriginal Affairs and Northern Development Canada (AANDC) developed legislation to address a long-standing and unacceptable legislative gap in regards to the rights of the surviving spouse(s) to reside in, or claim an interest in the family home (for example). Please see the attached pamphlet for more information on the Family Homes on Reserves and Matrimonial Interests or Rights Act.

Insert - if there is a competing spouse.

We have information that shows [NAME] as the spouse of the deceased. This legislation may affect your rights as a survivor (spouse and/or common-law partner) and you are encouraged to seek legal advice to decide whether to pursue your rights under either the Indian Act or the Family Homes on Reserves and Matrimonial Interests or Rights Act. Please keep in mind that you have only ten months after the date of death in which to make your application to court regarding the family home, or, if the deadline has expired, you can make application to the court for additional time.

Insert - if FNLMA Band.

[We have information that shows [NAME] as the spouse of the deceased.] You are encouraged to contact the band for information about reserve land in the name of the deceased and the Matrimonial Real Property provisions under the band's land code. As the survivor (common-law partner) your rights may be affected by those provisions.

Insert - if the First Nation has its own MRP Law under FHRMIRA.

[We have information that shows [NAME] as the spouse of the deceased.] You are encouraged to contact the band for information about reserve land in the name of the deceased. Also, as the survivor (common-law partner) the provisions in the band's Matrimonial Real Property law may affect your rights.

The Minister still has to appoint an administrator to look after [NAME]'s estate unless you choose to transfer jurisdiction to the province.

As this matter can potentially affect your legal rights, you may wish to seek legal advice.

Please make your decision, and let me know what it is, within 30 days from the date of the letter. If you have any questions, please phone me or send me an email message.

Sincerely,

Name

Title

Phone (Direct line):

Email: Your.Name@aandc-aadnc.gc.ca

Encl. Application for Administration form

MRP Pamphlet

Letter 2

Executor is/ is not the survivor and survivor is not a beneficiary

Your file:

Our file:

DATE

NAME

STREET ADDRESS

CITY PROVINCE POSTAL CODE

Dear NAME

Re: [NAME OF DECEASED]

I am an Estates Officer with Aboriginal Affairs and Northern Development Canada (AANDC) and I work on the estates of deceased First Nations people who lived on reserve. I have recently been informed of the death of [NAME]. Please accept our sincere condolences for your loss.

[NAME] was a status First Nations person who lived on-reserve. As a result, the legal rules that apply to his/her estate come from the Indian Act, and not from the laws of the Province of [Province or Territory]. When [NAME] made his/her will, you were named as the executor. However, in order for you to be able to carry out the wishes set out in the will, you need to apply to have your appointment as executor confirmed, which is why I am writing to you now. If you apply and are appointed, we will provide you with a legal document that confirms that the will is approved and that you have been officially appointed to look after the estate.

You have two options. Please choose only one of them:

- If you are willing and able to take on the job of being the executor of [NAME]'s estate, please complete the enclosed Application for Approval of Will form, and return it to me [ADD IF APPLICABLE with [NAME]'s original will. I will return the original will to you with a document confirming that you are the officially appointed executor of the estate].

OR:

- If for any reason you are not able to take on the job of being the executor of [NAME]'s estate, please complete the enclosed Renunciation of Personal Representative form and return it to me. I will then consult with the people named in the will to see if one of them is willing to act as the executor.

Insert - if the First Nation is not under FNLMA or does not have their own MRP law pursuant to the Act.

Also, in collaboration with First Nation people, communities and groups, Aboriginal Affairs and Northern Development Canada (AANDC) developed legislation to address a long-standing and unacceptable legislative gap in regards to the rights of the surviving spouse(s) to reside in, or claim an interest in the family home (for example). Please see the attached pamphlet for more information on Family Homes on Reserves and Matrimonial Interests or Rights Act (Act).

Insert - if the executor is not the survivor

We have information that shows [NAME] as the [spouse/common-law partner] of the deceased. Rights and protections are available to spouses and/or common-law partners regarding matrimonial real property on reserve under this legislation. Some of the rights and protections available are that a spouse or common-law partner may apply to the court for an order for short or long-term exclusive occupancy of the family home. This legislation may affect your administration of the estate because there is a survivor [spouse/common-law partner] who has not been named as a beneficiary in the will. The distribution of the estate may be affected by the legislation if the [spouse/common-law partner] makes application to court. The [spouse/ common-law partner] has 10 months after the date of death in which to make an application to court regarding the family home, or if the deadline has expired, can make application to the court for additional time.

Insert - if FNLMA Band

[We have information that shows [NAME] as the [spouse/common-law partner] of the deceased.] You are encouraged to contact the band for information about reserve land in the name of the deceased and the Matrimonial Real Property provisions under the band's land code. [As there is a survivor, (spouse or common-law partner) the administration of the estate may be affected by those provisions.] OR [As you are the surviving [spouse/common-law partner], your rights may be affected by these provisions].

Insert - if the First Nation has its own MRP Law under FHRMIRA.

[We have information that shows [NAME] as the [spouse or common-law partner] of the deceased.] You are encouraged to contact the band for information about reserve land in the name of the deceased. Also, as there is a (spouse or common-law partner) the provisions in the band's Matrimonial Real Property law may affect your administration of the estate. OR [As you are the surviving [spouse/common-law partner]) the provisions in the band's Matrimonial Real Property law may affect your administration of the estate.

Please keep in mind the Minister still has to appoint an administrator to look after [NAME]'s estate unless you choose to transfer jurisdiction to the province.

Please make your decision about whether or not you wish to be the executor, and let me know what it is, within 30 days from the date of the letter. If you have any questions, please phone me or send me an email message.

Yours truly,

Name

Title

Phone (Direct line): Email: Your.Name@aandc-aadnc.gc.ca

Encl. Application for Approval of Will form

Renunciation of Personal Representative form

MRP Pamphlet

Letter 3

Executor is not the survivor and survivor is beneficiary (there is a competing spouse)

Your file:

Our file:

DATE

NAME

STREET ADDRESS

CITY PROVINCE POSTAL CODE

Dear NAME

Re: [NAME OF DECEASED]

I am an Estates Officer with Aboriginal Affairs and Northern Development Canada (AANDC) and I work on the estates of deceased First Nations people who lived on reserve. I have recently been informed of the death of [NAME]. Please accept our sincere condolences for your loss.

[NAME] was a status First Nations person who lived on-reserve. As a result, the legal rules that apply to his estate come from the Indian Act, and not from the laws of the Province of [Province/Territory].

When [NAME] made his will, [he/she] named you as his executor. However, in order for you to be able to carry out the wishes set out in the will, you need to apply to have your appointment as executor confirmed, which is why I am writing to you now. If you apply, and are appointed, we will provide you with a legal document that confirms that the will is valid and that you have been officially appointed to look after the estate.

You have two options. Please choose only one of them:

- If you are willing and able to take on the job of being the executor of [NAME]'s estate, please complete the enclosed Application for Approval of Will form, and return it to me [ADD IF APPLICABLE with [NAME]'s original will. I will return the original will to you with a document confirming that you are the officially appointed executor of the estate].

OR:

- If for any reason you are not able to take on the job of being the executor of [NAME]'s estate, please complete the enclosed Renunciation of Personal Representative form and return it to me. I will then consult with the people named in the will to see if one of them is willing to act as the executor.

Insert - if there is a survivor and the First Nation is not under FNLMA or does not have their own MRP law pursuant to the Act.